As China’s middle class population grows, the pet ownership market is transforming from a fringe lifestyle choice into a rapidly growing consumer economy. Goldman Sachs estimates that the pet food market in China will be worth around USD $8.8B by 2030 growing at a CAGR of 8%, compared to the overall retail spending growth rate of around 2%.

But many are calling this estimate conservative, with the consumption of pet food estimated at over 300 billion RMB (USD $41.9 billion) during 2024 according to the White Paper on China’s Pet Industry in 20251. The USDA also found a similar level of USD $41.9 billion of spending in 2024, a 7.5% increase over 20232. Bloomberg Intelligence estimates the size of the market will be USD $49 billion by 20303.

- Estimated 120 million pets live in urban China.

- China’s urban population reached 930 million in 2023.

- Roughly 1 in 8 urban households now has a pet4.

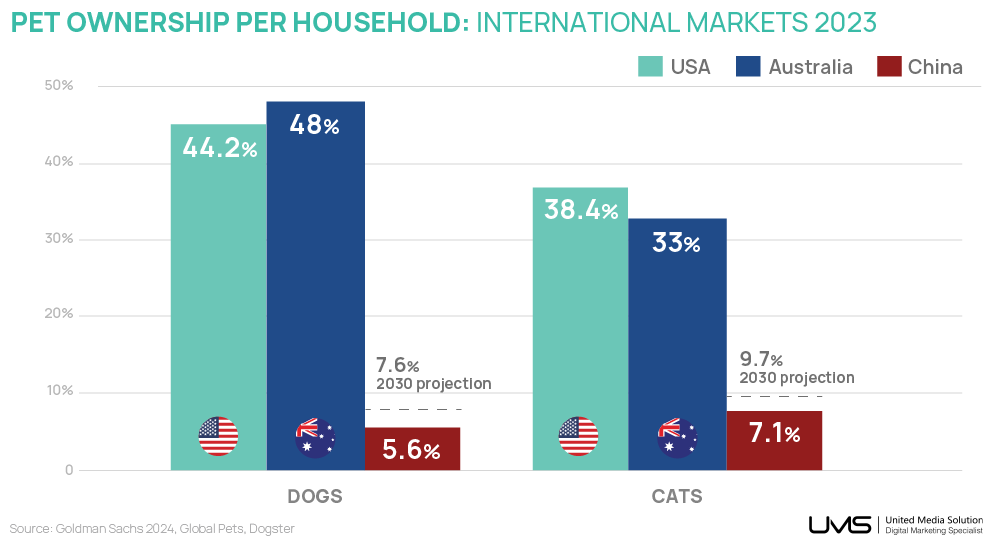

Pet ownership remains relatively low by international standards but is growing steadily.

- 7.1% of households owned a cat in 2023; projected to reach 9.7% by 2030.

- 5.6% of households owned a dog in 2023; expected to rise to 7.6% by 2030.

- In contrast, 44.2% of U.S. households own dogs, and 38.4% own cats5.

- In Australia, dog ownership is higher than the US, but cat ownership is lower.

Demographic Shifts: Pets Over Partners, Cats Over Kids

In China’s Tier 1 and Tier 2 cities, young single women, particularly those under 30, are increasingly turning to pet ownership as a source of companionship and emotional support. This demographic from the post-90s and post-00s generations, often prioritises their careers and personal freedom, leading them to choose pets over partners and traditional family structures and make up 77.7% of new pet owners6.

- Cats are preferred due to ease of care in apartment settings.

- These consumers are highly active on platforms like Xiaohongshu and Douyin.

- Willingness to spend on imported and premium products is high7.

Meanwhile the Silver Generation continues to grow in China. These empty nesters are rapidly adding pets to their household for emotional connection and companionship8. With more time spent at home, these consumers often watch pet-related content on platforms like Douyin, including entertainment and practical advice on pet care.

Imported Preference

Pet food accounts for 52.8% of total pet-related spending in China. Chinese consumers continue to favour imported pet food due to long-standing concerns about domestic food safety, especially after incidents affecting both humans and animals9.

- The U.S. holds a 69% market share of pet food imports to China.

- Royal Canin offers over 300 SKUs in China, with more than 100 formulas including those targeting issues like obesity and urinary health10.

Health and wellbeing focus

There is rising demand for functional foods and supplements for pets. Consumers seek similar nutritional profiles for pets as they do for themselves11. They will often discover these trends on social media from suggested content in their feed, along with ads that are run on ecommerce platforms. These will appear as paid promotions while people are shopping for other pet products.

Key product categories include:

- Joint, dental, liver, and immune support

- Treats for bonding and training, with lower calorie density

- High-end snacks with probiotics, collagen, and omega-3s12

- Some brands have introduced lactose-free dairy products and enzymatic pet grooming13

Consumers and online resellers flock to Pet Fair Asia Expo in Shanghai in August 2024.

Social Media Trends

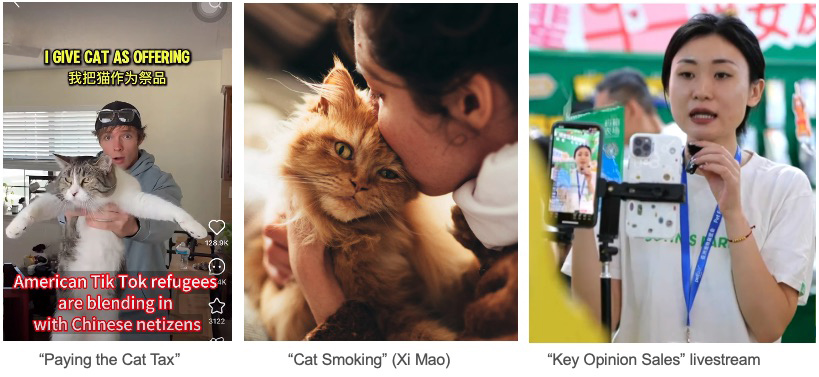

At the start of 2025, a flood of new users from the west joined Xiaohongshu (Little Red Book) from TikTok. To be welcomed onto the platform, Chinese netizens requested that these new users pay the “Cat Tax” and post pet related content. The new users were happy to oblige, and it highlighted the popularity of pet content for both Western and Chinese audiences.

In China, this enthusiasm for pet content is also known by the term “Cat Smoking” (Xi Mao), referring to cat owners’ exaggerated affection, such as sniffing their cats’ fur, and also refers to non-owners’ mild ‘addiction’ to regularly consuming cat-related social media content for entertainment.

Informative video content, including live streaming that covers healthy ingredients and benefits is popular on social media platforms. This is an important area for “Key Opinion Sales”. These are knowledgeable employees that can act as ‘brand representatives’, and live stream regularly during the week from a sales office, and at events like product expos.

Vertical videos dominate social media, particularly on platforms like Douyin and Xiaohongshu, and both platforms benefit from a ‘social commerce cycle’, where users discover products through reviews, purchase them, and subsequently create their own reviews, reinforcing the platform’s role as trusted peer-to-peer marketplaces, with deeper user engagement than ecommerce-only platforms. (Read more about the social commerce cycle in our China Social Media Platforms Guide download it here.)

China’s pet food market is poised for continued growth, driven by rising urban pet ownership, shifting demographics, and strong preferences for imported and functional pet food products. Young single women and the expanding Silver Generation significantly influence demand, particularly for premium and health-oriented items. E-commerce and engaging social media trends, reinforce product discovery and consumer engagement, providing a clear approach for international brands to connect with the China market.

For more information on this dynamic market, get in touch with us: sales@umssocial.com