China’s mobile in-app payment features and seamless integration of shopping experiences have positioned it as a global leader in social commerce. Valued at $425 billion USD in 2023[1], the market is projected to reach $745 billion USD by 2029[2]. Events like the 2024 Double 11 shopping festival exemplify the sector’s vitality, with a remarkable 46.5% surge in sales driven by Gen Z and millennial buyers. Notably, 13% of these sales were fuelled by Douyin, showcasing the growing influence of short-video platforms on consumer purchasing behaviour[3]. These developments show how China continues to lead innovation in social commerce, leveraging platforms like WeChat Mini Programs, Douyin, and Xiaohongshu (Red) to redefine the consumer journey.

Double Eleven Sales by Xinhua News

China’s social commerce growth starkly contrasts with the trajectory of Western e-commerce giants. While platforms like Alibaba and Douyin thrive, Amazon faces notable challenges. In 2023, Alibaba reported a 5% growth, generating $33.7 billion USD in revenue[4]. Douyin continues to revolutionize social shopping with features like livestreaming and short videos, fostering impulse buying among millions of active users.

On the other hand, Amazon lost 2.6 million users in 2024[5] and terminated its $1.7 billion iRobot acquisition announced in 2022[6]. These setbacks highlight the divergence in market approaches: Chinese platforms excel by capitalizing on community-driven commerce, while Amazon struggles to adapt to evolving consumer behaviours.

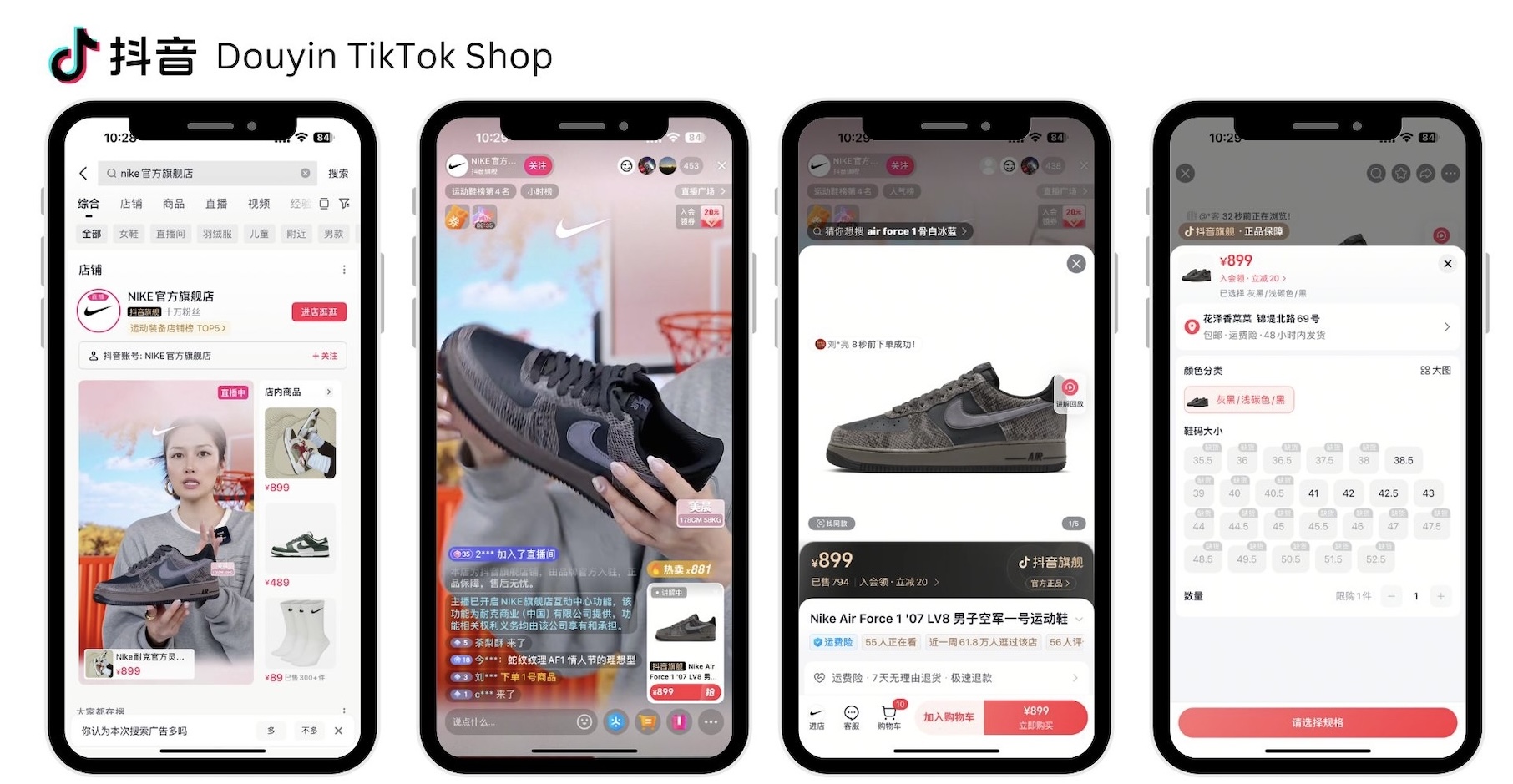

Douyin: Transforming Social Commerce

Douyin, with 748 million active users in 2024[7], has become a key player in China’s social commerce ecosystem. By seamlessly integrating short videos and livestreaming with in-app shopping, the platform has created a robust digital commerce ecosystem. In 2023, Douyin’s e-commerce segment achieved a gross merchandise value (GMV) of $375 billion USD[8]. The platform’s tipping system, where viewers reward livestream hosts, serves as an additional revenue stream while fostering stronger engagement between influencers and audiences[9]. This ecosystem has successfully lured consumers to Douyin Shop for their next purchases.

Douyin’s growth also reflects a shift in influencer marketing strategies. Where high-profile celebrities once dominated, key opinion leaders (KOLs) and everyday users, known as key opinion consumers (KOCs), now take center stage. These individuals are seen as more relatable and trustworthy, making them a cost-effective choice for brands. By prioritizing authenticity over glamour, Douyin has deepened consumer trust and engagement, further driving its e-commerce success. For businesses, understanding these shifts is essential for long-term growth.

WeChat: A Multi-Functional Commerce Ecosystem

With 945 million monthly active users as of March 2024[10], WeChat has evolved far beyond a messaging app. It now serves as a multi-functional ecosystem integrating e-commerce, social networking, and payment solutions. Key to its success is the Mini Program ecosystem, which allows businesses to streamline operations and offer innovative features like livestream shopping integrated with WeChat Pay. This seamless payment process enhances user experience and reduces cart abandonment rates, a common challenge in online shopping.

Livestreaming has gained immense traction within WeChat’s ecosystem, with generation Z users being the most active users[11]. Among users born between 1990 and 1999, 92% participate in livestreaming, underscoring its popularity[12]. For brands, creating engaging and interactive sessions within Mini Programs has become a strategic priority to leverage these advanced features.

Xiaohongshu (Red): The Power of Community-Driven Commerce

Xiaohongshu (Red) has emerged as a formidable player in China’s social commerce ecosystem, with 300 million monthly active users in 2024[13]. Its success lies in its user-generated content (UGC)-driven model, with 90% of the platform’s material created by its community[14]. This approach fosters a dynamic cycle of social commerce, encompassing brand discovery, purchasing, reviews, and promotion.

In Q1 2024, Xiaohongshu recorded $1 billion in sales and $200 million in net profit, propelled by increased advertising from retailers targeting Gen Z women—its core demographic[15]. Red’s strength lies in its seamless blend of social engagement and e-commerce. Many of its users actively engage in recommendation-based affiliate marketing, where users promote products or services they love without formal or apparent sponsorships[16].

This organic approach builds trust and authenticity, differentiating Red from platforms like WeChat or Douyin. By prioritizing genuine connections and leveraging its vibrant community, Xiaohongshu offers brands unparalleled opportunities to connect with China’s digitally savvy and discerning consumers.

Make sure to check out the rest of our Top Trends in China for 2025.

[1] https://www.globenewswire.com/news-release/2024/02/28/2837206/0/en/China-Social-Commerce-Market-Worth-745-3-Billion-by-2029-Trends-and-Analysis-Featuring-Douyin-Live-Shopping-Taobao-Live-Kuaishou-Pinduoduo-and-Taobao-Marketplace.html

[2] https://finance.yahoo.com/news/china-social-commerce-market-intelligence-013000492.html

[3] https://eu.36kr.com/en/p/3034260512600320

[4] https://www.digitalcommerce360.com/article/alibaba-revenue

[5] https://www.forbes.com/sites/petercohan/2024/03/21/down-by-26-million-users-amazon-could-keep-losing-customers-to-temu

[6] https://media.irobot.com/2024-01-29-Amazon-and-iRobot-agree-to-terminate-pending-acquisition

[7] https://www.statista.com/statistics/1361354/china-monthly-active-users-of-douyin-chinese-tiktok

[8] https://kr-asia.com/douyin-e-commerce-targets-rmb-4-trillion-gmv-in-2024-measuring-up-to-pinduoduo

[9] https://www.sixthtone.com/news/1006370

[10] https://www.demandsage.com/wechat-statistics

[11] https://www.statista.com/statistics/1483250/wechat-channels-penetration-rate-live-streaming-by-age-group

[12] https://www.statista.com/statistics/1483250/wechat-channels-penetration-rate-live-streaming-by-age-group

[13] https://www.prnewswire.com/apac/news-releases/xiaohongshu-unveils-trend-report-on-search-habits-among-chinas-youth-302220915.html

[14] https://mp.weixin.qq.com/s/AigCvTm7B9muVQREmgOAqg

[15] https://www.ft.com/content/81d4324a-1137-4c32-935f-bfb3f2b84a1a