As global travel starts to make a comeback and return to a ‘new normal’, New Zealand is engaging with China to rekindle its tourism industry, an industry that faced considerable setbacks during the COVID-19 pandemic and recent flooding events. New Zealand exported NZD$3.4 billion of services to China in 2019 (around 17% of exports overall), and nearly 90% of those exports were related to tourism and education[1].

High-level New Zealand Delegation to China

New Zealand’s Prime Minister, Chris Hipkins, is leading a 29-member strong business delegation to China this week. The delegation consists of representatives of various key industries, including tourism and education sectors, along with prominent business figures. They are visiting Beijing, Tianjin and Shanghai during the delegation program, which includes a range of events centred on business-to-business partnerships and a gala dinner to promote New Zealand products and establish business connections[2].

The trip will also see the Prime Minister launching a significant tourism partnership in Shanghai on behalf of Tourism NZ. Hipkins is looking forward to showcasing New Zealand’s innovative, world-class products and services in Shanghai – with a population of more than 24 million, the city is one of the world’s largest consumer markets.

Accompanying the Prime Minister are Trade and Export Growth Minister Damien O’Connor and Tourism Minister Peeni Henare. It is the largest group of government ministers from any Western country to attend China since the pandemic, and it underscores New Zealand’s commitment to reinvigorate its tourism industry and broader economic ties with China.

The Importance of China for New Zealand’s Tourism Recovery

Prior to the pandemic, China was one of the largest sources of international tourists for New Zealand. In 2019, Chinese tourists spent $1.7 billion in the country, according to Tourism New Zealand, and the number of arrivals reached 448,000, making China New Zealand’s largest international market besides Australia (1.5 million visitors)[3].

The sudden halt in Chinese tourism during the pandemic had a substantial impact on New Zealand’s economy, given that tourism accounted for about 5.8% of the country’s GDP in 2019 but only accounted for 3.0% in 2022[4]. This drop of around NZ$7 billion impacted thousands of workers and business owners across the country.

Chinese tourists spend significantly more when visiting New Zealand than people from other nations. Many years ago, Chinese tourists were arriving in large tour groups, but now there is an increasing trend of more affluent free and independent travellers that are interested to visit New Zealand. We asked the CEO of Tourism Holdings Limited, Grant Webster: How can New Zealand tourism providers appeal to these affluent consumers?

“Most often, the affluent Chinese market is after exactly the same type of experience as other markets. NZ tourism operators have become quite adept at assisting our Chinese customers to have a great experience,” said Grant.

He also commended the promotional work of government agencies to support the tourism industry in regard to social media capability and resources.

“Tourism New Zealand is leading the way with these new opportunities. They provide excellent guidance and support alongside the general New Zealand message they deliver competently.”

A Digital First Strategy to Attract Chinese Tourists

New Zealand will need to work hard to compete with other global destinations that are desperate to make up lost ground. New Zealand brands will need to target potential Chinese tourists, ideally affluent ones, that are keen and ready to travel. Using digital marketing techniques to segment and identify audiences will be vital to reach the target market in high-tier cities in China. Brands can then showcase the unique attractions and experiences New Zealand has to offer using attractive photography and dynamic video content.

New Zealand locations became famous worldwide with the Lord of the Rings films that also became well known in China. The Hobbiton Movie Set attraction welcomes thousands of tourists every year to experience the landscape’s natural beauty.

While Tourism New Zealand has been successful in marketing the country overall, individual tourism businesses will need to promote their offerings effectively. Much of this capability has been lost during the pandemic as tourism businesses were forced to reduce head count. This internal capability will take time to rebuild for brands. Collaboration and resource sharing in key sectors will help brands to develop effective marketing strategies and deploy engaging digital content in China.

Chinese Interest in New Zealand is Increasing

Chinese tourists are interested in travelling to New Zealand. A recent Tourism New Zealand survey of people that are ‘actively considering’ travel indicated that 62% of respondents in China had New Zealand as their first destination choice, compared to 41% of Japanese. A further 27% of those respondents in China indicated they were ready to book travel[5].

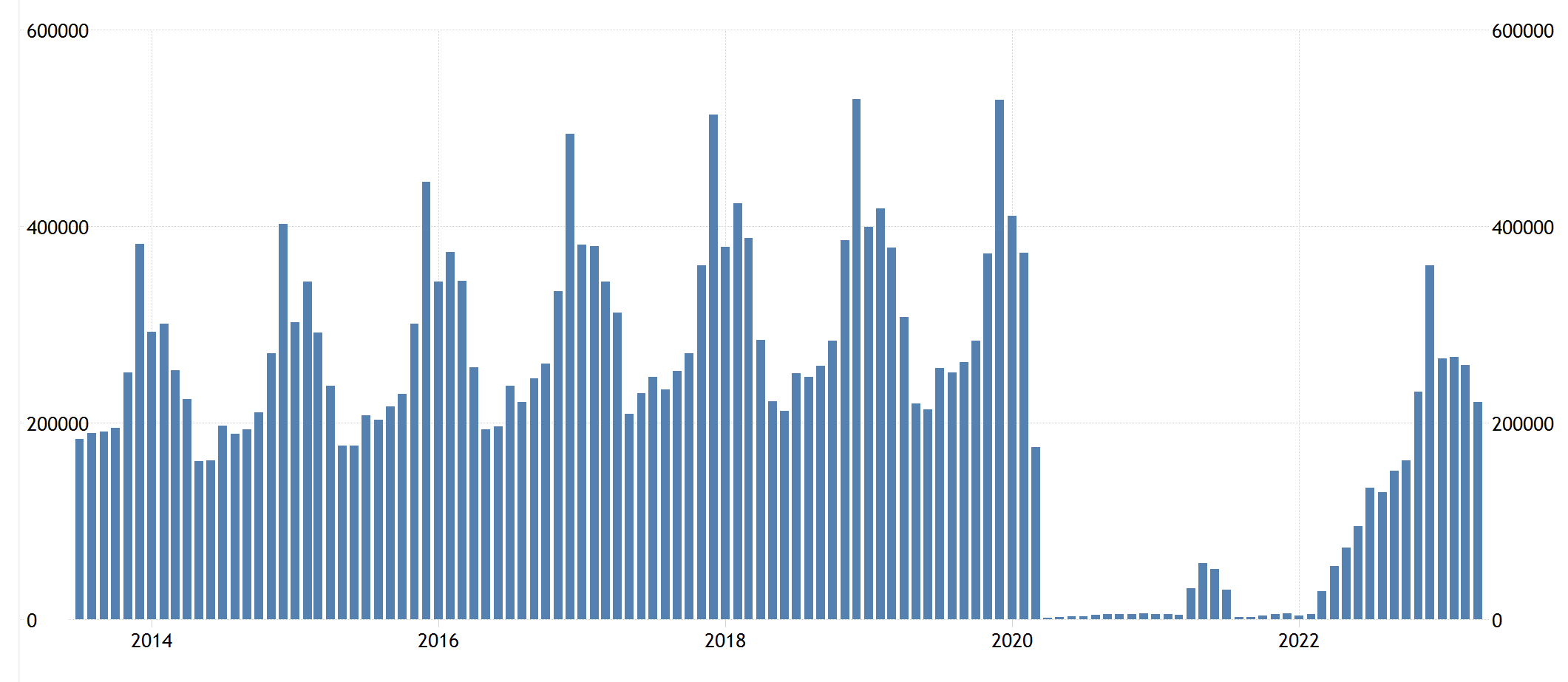

The seasonal nature of tourism requires marketing and communications efforts to be deployed well ahead of time. This chart shows the annual rise and fall of tourist arrivals gradually rising before the pandemic, with visitors from northern hemisphere countries clearly enjoying the warmer summer months. The gaping hole left by border closures and the work required to rebuild tourist numbers is clear.

NEW ZEALAND TOURIST ARRIVALS

Image Credit: Trading Economics, Statistics New Zealand, May 2023[6]

We asked Tourism New Zealand’s General Manager for Asia, Gregg Wafelbakker about the competitive position that New Zealand now finds itself in, with the rest of the world promoting travel options to a massive market in China.

“Competition for global travellers is fierce, Tourism New Zealand is working hard to showcase its unique offering to high-quality visitors in key markets. It’s critical that a destination understands its audience and provides them with content that addresses any barriers to travel and inspires them with content that addresses what they are looking for.”

“Our research tells us that Chinese tourists enjoy winter travel and nature activities, are looking for meaningful experiences and are keen to learn about the culture and enjoy great food and wine. New Zealand has all of this and more, so we are making sure to showcase that in our work. We are also making sure we are using channels that our key audience are using.” Gregg noted.

Harnessing Digital Platforms in China

In China, internet users access content primarily through smartphone apps rather than PC web pages. An in-depth knowledge of the different ecosystems of apps and social media platforms in China is needed to effectively create and deploy content to keep the target market audience engaged regularly.

Many brands with experience in the China market will be familiar with WeChat and the importance of establishing an official account. But during the pandemic, Chinese citizens became even more engaged with their digital devices, and various other platforms are thriving. One of these includes the Chinese version of TikTok, known as Douyin, which specialises in short video content provided by platform users (user-generated content). The popular app Kuiashou also delivers similar video content.

But the most important platform to establish a presence on now is Xiaohongshu or ‘Little Red Book’, often just referred to as RED. It is the Chinese equivalent of Instagram and holds the same influential status in China as that Instagram does in the West. Key style leaders and tastemakers across all sectors, including fashion, food and travel, curate their feeds and promote products, services and experiences to their followers.

Influencers are known as Key Opinion Leaders in China (KOLs), and they command high fees to promote to their millions of followers. However, it has become more popular for brands to seek out ‘Key Opinion Consumers’ with smaller followings to collaborate with. KOCs are more relatable to everyday personalities and can be compared to ‘Mom-fluencers’ and travel bloggers in Western social media rather than elite style icons and professional models.

Most Western social media platforms are not available in China; therefore being active on key Chinese platforms and using them to promote services and experiences can help businesses effectively target and engage prospective consumers. Understanding the nuances of these platforms and tailoring marketing efforts accordingly is crucial to success.

Conclusion

As New Zealand works to recover from the economic disruption of the pandemic, reconnecting with China is essential for reviving its tourism sector. With an appreciation for Chinese culture and a focus on effective marketing strategies, New Zealand can attract Chinese tourists and offer them unique experiences.

With a rebounding interest in China for international travel and a strong preference for New Zealand among potential holidaymakers, New Zealand must seize the opportunity to reconnect with China and not be left behind in the global competition for travellers.

[1] New Zealand China Council Report, Assessing future prospects for New Zealand China services trade, November 2022

https://nzchinacouncil.org.nz/2022/11/normal-service-resumed-assessing-future-prospects-for-new-zealand-china-services-trade/

[2] www.beehive.govt.nz , Speeches

https://www.beehive.govt.nz/speech/prime-minister-rt-hon-chris-hipkins-peking-university

[3] Scoop Business, China Update, 2 March 2023

https://www.scoop.co.nz/stories/BU2303/S00031/nz-tourism-industry-warned-expect-a-different-chinese-tourist-post-covid.htm

[4] NZ Tourism Satellite Account: 2019 and 2022, MBIE (Annual results)

https://www.mbie.govt.nz/assets/tourism-satellite-account-2019.pdf

[5] TNZ KANTAR Active Considerer (AC) Monitor Asia Key markets: July-Dec 2022, (Published Feb 2023)

https://www.tourismnewzealand.com/assets/insights/intl-research/active-considerers/TNZ-ACM-H1-FY23_Asia-Key-Markets-9-v2.03.23.pdf

[6] Trading Economics, Statistics New Zealand, May 2023

https://tradingeconomics.com/new-zealand/tourist-arrivals